Hindustan Aeronautics Limited (HAL), a key player in India’s aerospace and defense sector, has shown significant market performance with a current market capitalization of ₹2,71,894 crore. Trading at ₹4,066, Hindustan Aeronautics Limited share price is experiencing fluctuations with a 52-week high of ₹5,675 and a low of ₹2,041. This analysis explores HAL's financial performance, stock valuation, technical analysis, and industry position to provide insights into its future potential.

HAL’s financial metrics indicate solid performance in the aerospace and defense sector. The company’s Price-to-Earnings (P/E) ratio of 33.1 reflects market confidence, despite trading at a premium valuation. With a book value of ₹434, HAL’s stock trades at 9.44 times its book value, which suggests that investors are willing to pay a significant premium for its shares.

HAL’s Return on Capital Employed (ROCE) stands at an impressive 38.9%, while the Return on Equity (ROE) is 28.9%, indicating effective resource utilization and profitability. The dividend yield is relatively modest at 0.82%, but HAL has maintained a dividend payout ratio of 29.6%, reflecting its commitment to shareholder returns. Notably, HAL has achieved a strong profit growth rate of 26.5% CAGR over the past five years.

Pros:

HAL is almost debt-free, contributing to financial stability.

Consistent profit growth with a 26.5% CAGR over the last five years.

Impressive ROE, with a three-year average of 28.4%, showing sustained profitability.

Efficient management of working capital, reducing working capital requirements from 62.2 days to 37.1 days.

Cons:

High valuation, trading at 9.44 times its book value.

Moderate sales growth of 8.71% over the past five years.

Decline in promoter holding over the last three years by 3.51%, which could raise concerns among investors.

In the aerospace and defense industry, HAL faces competition from companies like Bharat Dynamics, BEML Ltd, MTAR Technologies, and Paras Defence. HAL's P/E ratio of 33.1 is comparatively lower than MTAR Technologies (124.86) and Ideaforge Tech (143.37), making it more attractively valued within the industry.

HAL’s ROCE of 38.9% stands out, especially compared to Bharat Dynamics at 24.23% and BEML Ltd at 15.25%. In terms of dividend yield, HAL's 0.82% is higher than most of its peers in the aerospace and defense sector, offering some stability in returns. Overall, HAL's robust financials and consistent growth provide a strong competitive position within the sector.

In its recent quarterly results, HAL reported sales of ₹4,348 crore, showing an increase from previous quarters. The operating profit margin (OPM) stood at a strong 23%, indicating efficient operations. Net profit for the quarter was ₹1,436 crore, a considerable improvement driven by cost control and operational efficiencies.

The company’s quarterly earnings per share (EPS) was ₹21.47, up from ₹18.47 in the previous quarter. HAL’s focus on advanced aerospace manufacturing and defense projects has led to stable revenue growth and improved profit margins, supporting its market valuation.

HAL has demonstrated stable long-term growth, with a 10-year compounded annual growth rate (CAGR) of 7% in sales and 11% in profits. In the last five years, HAL’s profit CAGR has accelerated to 26%, highlighting improved profitability. The stock price has grown at a 5-year CAGR of 60%, rewarding long-term investors with substantial returns.

The company’s 3-year ROE of 28.4% underscores its efficiency and ability to generate returns for shareholders. HAL’s solid performance in profitability and asset utilization, coupled with low debt, positions it as a strong player in the Indian aerospace and defense sector.

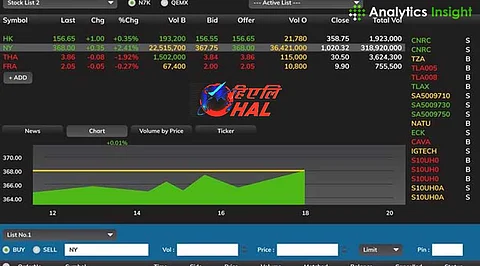

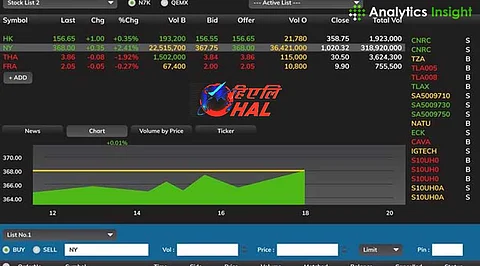

HAL’s recent stock chart reflects a downward trend after reaching a peak around ₹5,675. The stock currently trades around ₹4,066, near key support levels. On the daily chart, HAL’s price has crossed below multiple moving averages, including the 50-day, 100-day, and 200-day SMAs, indicating a bearish sentiment in the short term.

The Bollinger Bands on the daily chart show that the stock has breached the lower band, suggesting a potential oversold condition. This may lead to a short-term rebound, as prices often return to the mean after reaching extreme levels. The immediate support for HAL lies around ₹4,050, while the resistance level is near ₹4,300. If the stock sustains above its support, it may see recovery towards the resistance.

Volume analysis reveals increased selling pressure in recent sessions, which aligns with the downward trend. A sustained increase in buying volume could indicate a potential reversal in sentiment, especially if the stock breaks above the resistance at ₹4,300.

HAL’s dividend yield of 0.82% is relatively modest, but the company’s consistent dividend payout of 29.6% provides stable returns for shareholders. The dividend yield reflects HAL’s commitment to rewarding investors, even as it balances growth with capital conservation for future projects.

The company’s stock price has shown a remarkable 5-year CAGR of 60%, driven by strong fundamentals and market confidence in the aerospace sector. For income-focused investors, HAL’s dividend payout and capital appreciation provide a balanced approach to long-term wealth creation.

HAL is a leader in India’s aerospace and defense sector, manufacturing fighter jets, helicopters, and various defense components. As part of several major indices, including BSE 500, BSE Capital Goods, and BSE 100, HAL holds a prominent position in the market. Its inclusion in these indices reflects its importance in the defense industry and the broader Indian market.

The Indian government’s focus on self-reliance in defense manufacturing presents growth opportunities for HAL. The company has secured multiple defense contracts, which ensures a steady revenue stream. HAL’s expertise in advanced aerospace technology and defense manufacturing provides it with a competitive edge, particularly as India emphasizes indigenous defense production.

HAL’s growth potential lies in its ability to expand its product portfolio and capitalize on India’s defense modernization initiatives. The company is working on new-generation aircraft, helicopters, and drones to meet the evolving needs of the Indian armed forces. Additionally, HAL has been exploring export opportunities to further diversify its revenue base.

India’s defense budget continues to grow, and the government’s Make in India initiative has fueled demand for indigenous defense products. HAL’s low debt levels, efficient operations, and strong order book position it well to benefit from these favorable trends. However, achieving consistent sales growth remains a challenge, as reflected in HAL’s moderate 8.71% sales CAGR over the past five years.

To drive future growth, HAL is investing in research and development (R&D) to enhance its technological capabilities. The company’s focus on innovation, coupled with strategic partnerships and collaborations, could help it capture a larger share of the domestic and international defense markets.

Based on the technical and financial analysis, here are the key levels for HAL:

Support Levels: Immediate support at ₹4,050, with stronger support at ₹4,000. A breakdown below these levels could lead to further declines.

Resistance Levels: Key resistance at ₹4,300, with a secondary level around ₹4,560. A breakout above these levels may signal renewed bullish momentum.

Investors should monitor these levels to identify potential buying or selling opportunities, particularly in light of recent volatility.

Investors should consider the following risks when evaluating HAL:

Valuation Concerns: HAL is trading at 9.44 times its book value, which may indicate a premium valuation.

Sales Growth: The company’s sales growth has been moderate, which could impact long-term profitability.

Market Volatility: HAL’s stock price is sensitive to market sentiment, and changes in defense policies or contracts may impact its performance.

Hindustan Aeronautics Limited (HAL) is a strong player in India’s aerospace and defense industry, backed by solid financials, low debt, and government support. With a robust ROCE of 38.9% and consistent profit growth, HAL offers stability for long-term investors. The company’s focus on advanced defense manufacturing, coupled with strategic initiatives, positions it well for future growth.

The current stock price around ₹4,066 provides an opportunity for investors to assess HAL’s long-term potential, especially if the stock sustains above key support levels. For long-term investors, HAL’s dividend payouts, profitability, and role in India’s defense sector make it an attractive choice. However, valuation concerns and moderate sales growth remain areas to watch as the company navigates future challenges and opportunities in the aerospace industry.