Bitcoin mining is often criticized as an energy hog, a symbol of the tech industry’s worst excesses in the age of climate crisis. The process—computers solving complex cryptographic puzzles to secure transactions and create new coins—demands staggering amounts of power. The energy consumption is so high, in fact, that Bitcoin’s annual electricity use has been compared to that of entire nations. This has made it a lightning rod for criticism from environmentalists and policymakers, who see it as a troubling contradiction: a digital future built on an unsustainable foundation.

But there’s another side to the story, one that’s beginning to change the narrative. A growing number of innovators are looking for ways to turn Bitcoin mining’s energy appetite into something more constructive, reframing the technology not just as a challenge but as an opportunity. Akbar Shamji, the CEO of an ESG-focused data center company, stands out as one of those trying to redefine what’s possible. His approach is simple but radical: instead of letting the waste heat from mining dissipate into the atmosphere, he aims to harness it to power something useful.

This shift begs a bigger question: Can Bitcoin mining, the poster child of tech’s carbon footprint, actually become a part of the solution? It’s a question that goes beyond the usual headlines about cryptocurrency’s environmental impact and taps into something deeper: the idea that the tools of modern technology, if reimagined, might be able to address the very problems they’re often accused of creating. If innovators like Shamji can make this work, they might just turn Bitcoin from a climate liability into a climate ally.

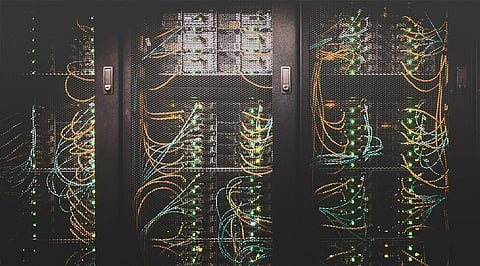

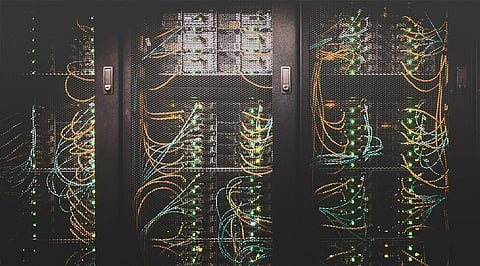

Bitcoin mining runs on a system called “proof of work,” a mechanism that’s both the backbone of the cryptocurrency and the root of its environmental problem. In simple terms, it’s a global contest where specialized computers—miners—race to solve complex mathematical puzzles. These puzzles are crucial for securing transactions and maintaining the integrity of the Bitcoin network. But they demand immense computational power, and the machines tasked with solving them run around the clock, crammed into data centers that hum with the relentless churn of high-powered processors. The result is an energy consumption profile that would make any environmentalist wince.

This voracious demand for power has real-world implications, especially in regions where fossil fuels dominate the energy grid. In places where coal or natural gas is the primary electricity source, the carbon emissions from mining operations can be staggering. Even as some miners seek out cheaper, renewable energy sources, a significant chunk of the industry still draws on non-renewable grids, adding millions of tons of carbon dioxide into the atmosphere.

It’s no surprise that this has sparked a backlash. Environmentalists, regulators, and policymakers have all raised the same pointed concern: the promise of a decentralized financial system must be weighed against its ecological toll. Critics argue that in a world where reducing carbon emissions is a matter of urgency, Bitcoin’s energy appetite is a luxury we can’t afford. And so, the pressure is mounting for the industry to clean up its act—to shift towards renewable energy, to explore alternatives like “proof of stake,” or to find other ways to mitigate its impact. But the deeper issue remains whether Bitcoin mining can transition from being an energy drain to a more climate-conscious process, or if its environmental costs will continue to overshadow its digital ambitions.

Enter Akbar Shamji, an entrepreneur with a vision that challenges the way we think about Bitcoin mining’s biggest problem: the massive amounts of excess heat it generates. As the founder of a company dedicated to designing sustainable data centers, Shamji isn’t content with making small improvements—he’s working to turn a key problem of mining, its waste heat, into a solution. His approach isn’t just about making Bitcoin mining slightly less damaging; it’s about turning its core byproducts into assets.

In most mining setups, the heat from those non-stop calculations is seen as a problem to solve—something to be cooled and managed. Shamji sees it differently. Using advanced heat recovery systems, his data centers capture that excess thermal energy and channel it into greenhouses, providing consistent warmth for crops. It’s a simple idea with big implications. In cold climates, where heating is often a necessity for year-round growing, this approach offers a lifeline to local agriculture, reducing the need for traditional fossil-fuel heating systems and creating a more sustainable energy loop. Instead of thinking of Bitcoin mining’s heat as waste, Shamji’s model treats it like a resource—one that can turn digital infrastructure into a partner for sustainable farming.

This shift goes beyond cutting energy costs; it’s about creating a genuinely circular economy, where the byproducts of one industry become the lifeblood of another. Shamji’s hydro-powered data center in Norway is a case in point. Using renewable hydropower to drive the mining operations, the center then recycles the heat into nearby greenhouses, helping them stay productive through the coldest months. The result is not only a smaller carbon footprint for Bitcoin mining but also a local food system that’s more resilient and less dependent on fossil fuels. It’s the kind of approach that suggests a new possibility—where the tools of the digital age, when applied differently, could contribute to a greener economy.

Akbar Shamji’s heat-recycling data centers point to a bigger idea: a future where tech companies, renewable energy providers, and local communities collaborate to redefine the relationship between digital infrastructure and sustainability. Think of it as a new kind of ecosystem, where Bitcoin miners go beyond power consumption to actively contribute, turning waste heat into a resource that fuels local agriculture or stabilizes regional energy grids. It’s a vision where the worlds of digital currency and renewable energy intersect, not only for efficiency but to fundamentally change how industries interact with their surroundings.

These kinds of partnerships could also transform the public’s view of Bitcoin mining. For years, the story has been about excessive energy use and environmental harm—a narrative that has kept Bitcoin in the crosshairs of climate activists and policymakers. But imagine if Bitcoin mining could pivot to something different: a driver of local resilience, a partner to renewable energy projects, a contributor to sustainable development. As projects like Shamji’s gain traction, they could flip the script, attracting investors who see the potential in a more environmentally integrated approach to digital currency. Instead of being seen as an ecological burden, mining could become part of the solution—proof that the tech world can innovate its way out of its own contradictions.

Regulation will be key to turning this vision into reality. Up to now, most government policies have treated Bitcoin as a problem to handle rather than an opportunity to seize. But that could change. What if policymakers started offering tax breaks or incentives for mining operations that partner with local renewable energy projects or repurpose their heat output? What if grants were available for data centers willing to innovate in ways that cut carbon emissions? These kinds of regulatory shifts could turn efforts like Shamji’s into a broader movement, making it easier for green-minded entrepreneurs to scale their ideas. In the end, it could mean a future where digital progress and climate action aren’t at odds, but part of the same story.

Join our WhatsApp Channel to get the latest news, exclusives and videos on WhatsApp

_____________

Disclaimer: Analytics Insight does not provide financial advice or guidance. Also note that the cryptocurrencies mentioned/listed on the website could potentially be scams, i.e. designed to induce you to invest financial resources that may be lost forever and not be recoverable once investments are made. You are responsible for conducting your own research (DYOR) before making any investments. Read more here.